The Blog

How to Avoid the Three Biggest Homeownership Blunders Everyone wants to avoid these three biggies: Don’t worry, there are plenty of things you can do to prevent these blunders. Here’s a rundown of the simple steps you can take to keep your home in tiptop shape – what to look out for, how to prevent […]

continue reading...

It’s the Fun “House Hunting” Guide Love Buying a Home series – Week 7 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure […]

continue reading...

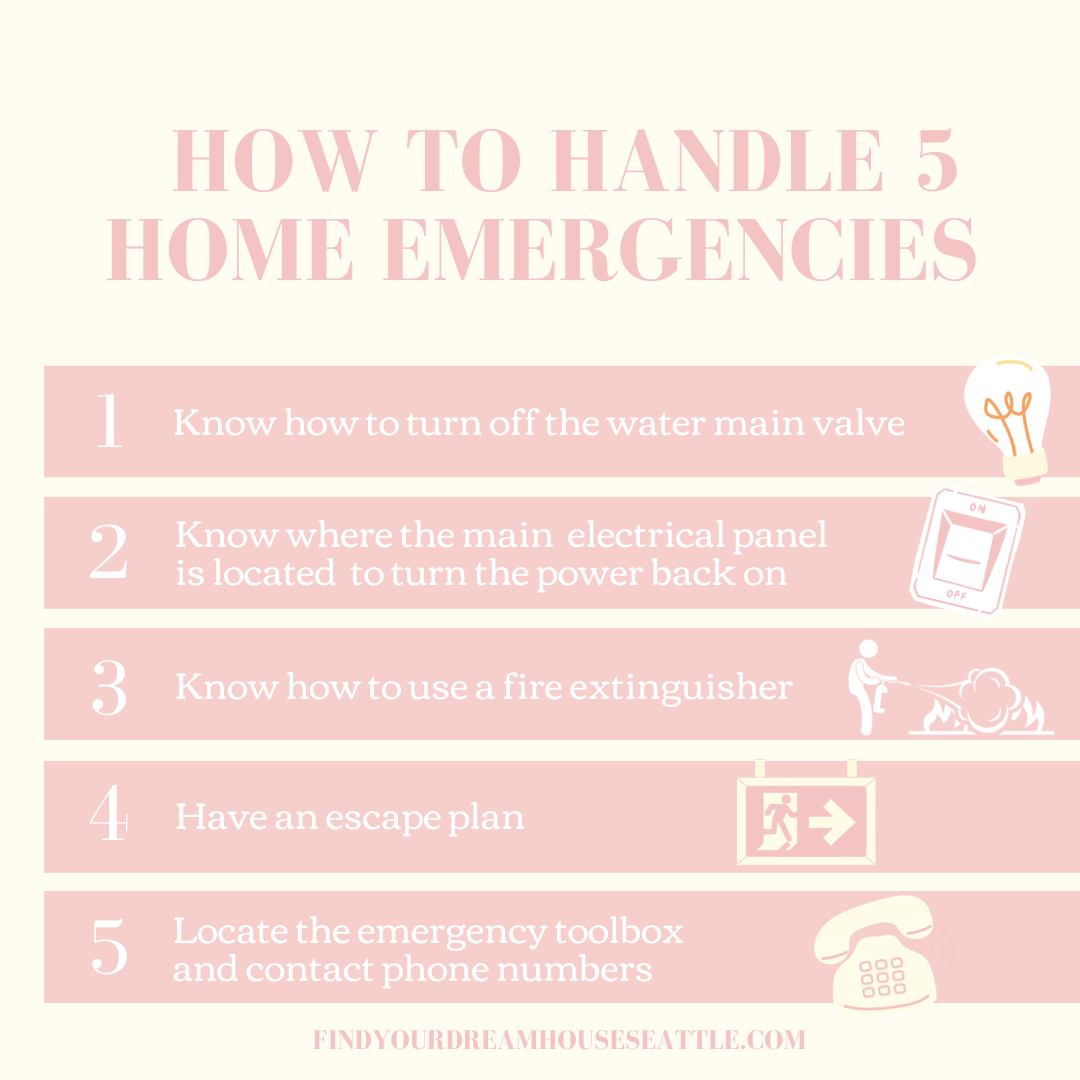

How to Handle 5 Home Emergency Situations As a homeowner, it’s fun to enjoy all the great things about your home—place to relax, entertain, or spend quality time with family. But what about when something goes wrong? Do you know what needs to be done in case of an emergency or other urgent […]

continue reading...

Should You Buy When Interest Rates Are High? Making the jump from renting to homeownership can be incredibly intimidating, and how do you know if this is a “good market” to buy in? The answer may surprise you. While interest rates have been higher in the last year or two, home prices have decreased and […]

continue reading...

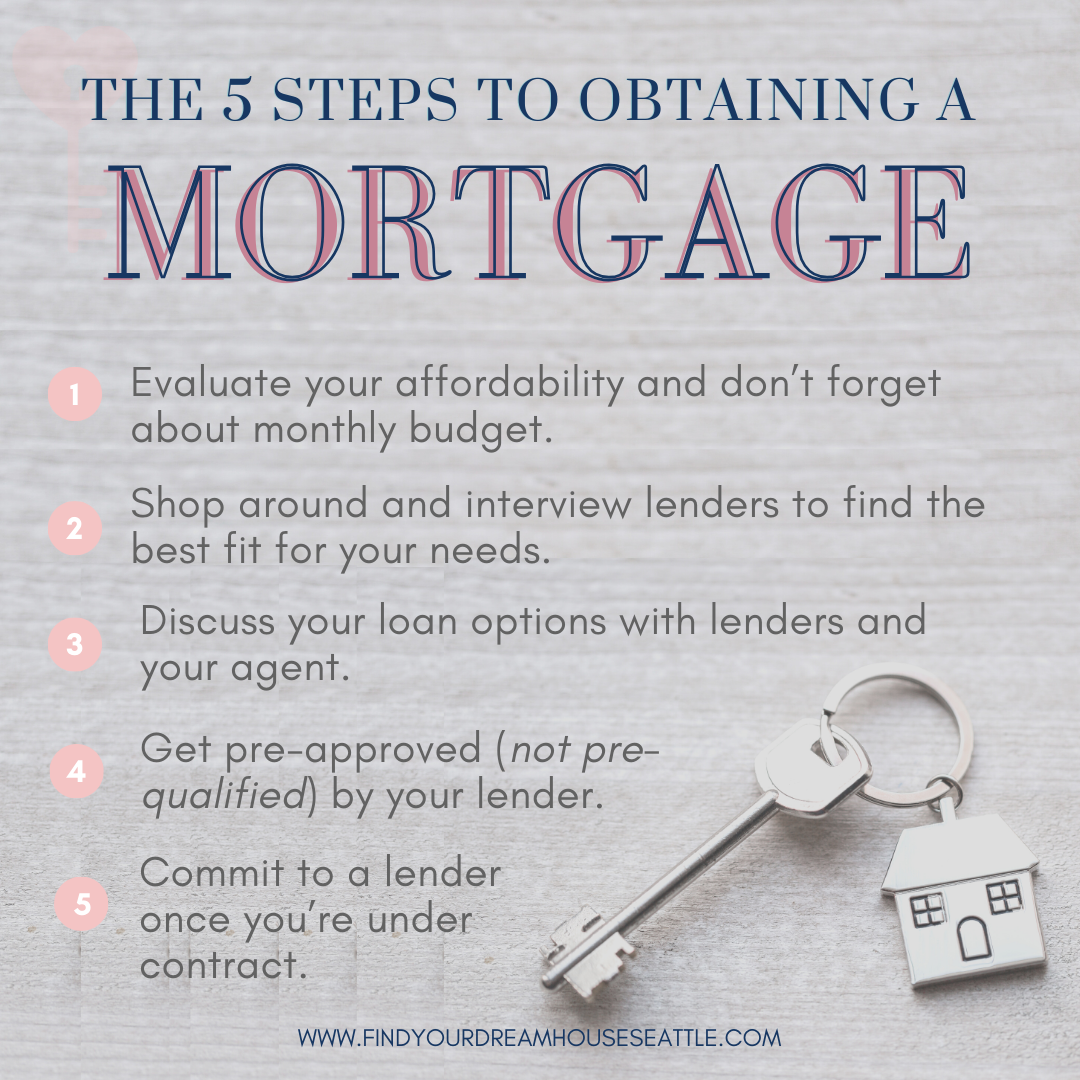

5 Steps to Obtaining a Mortgage Love Buying a Home series – Week 6 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure […]

continue reading...

Get Going on Your Home Maintenance Should’ve, would’ve, could’ve. Don’t make that your mantra when it comes to your home’s maintenance! Preventative maintenance is worth your time and money NOW to avoid costly home disasters later. You don’t want to be the one saying, “I should’ve caulked those windows for a few bucks a tube,” […]

continue reading...

Where to Find Money for Your Down Payment Love Buying a Home Series – Week 5 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. […]

continue reading...

20 Survival Tips for Homeowners Being a homeowner can be exciting and fun at times, with lots of freedom to make it your own space! As a homeowner, though, you’re the one in charge of any repairs, maintenance, finances, and improvements over the long haul. Whether you’re a first time homeowner or you’ve owned many, […]

continue reading...

Do the Math – A Mortgage You Can Afford Love Buying a Home Series – Week 4 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and […]

continue reading...

3 Common Mistakes that Lower Credit Scores Whether you know it or not, there might be things you are doing that can effect your credit score for the worse. Even if you aren’t buying a home anytime soon, you don’t want to be surprised by your credit score when you want to buy a […]

continue reading...

Hi, I’m Rose Voorhees and I love helping first time homebuyers in Seattle make buying their first home more affordable. Let me show you how!

Having lived and worked in Seattle for over a decade, I am passionate about making homeownership accessible to the people responsible for this city's valuable culture and community.

For that reason, I work with first time homebuyers to help them build wealth and stability in a city where rent continually prices out the very people who built it.

Contact me today to learn how to achieve your homeownership dreams. Schedule a free consultation now!