My Blog

How To Prepare Now to Buy Your First Home Next Year in Seattle Buying a home takes a lot of preparation and planning. It’s important to get your finances in order and other tasks done before you even start house hunting! Keep in mind that this early stage of the buying process doesn’t happen overnight. […]

continue reading...

Never Trust a Zestimate At one point or another, we’ve all spent a little too much time browsing homes online. Touring can be one of the most fun parts of buying, it’s hard to resist looking! If you look too closely however, it’s easy to feel discouraged by the pesky monthly estimate next to the […]

continue reading...

Say Good-bye to Your PMI When you bought your home, you might have had to get Private Mortgage Insurance (PMI). If so, you might have been paying it for a while and it could be time to petition your lender to stop this payment requirement. For a quick recap — PMI is insurance that […]

continue reading...

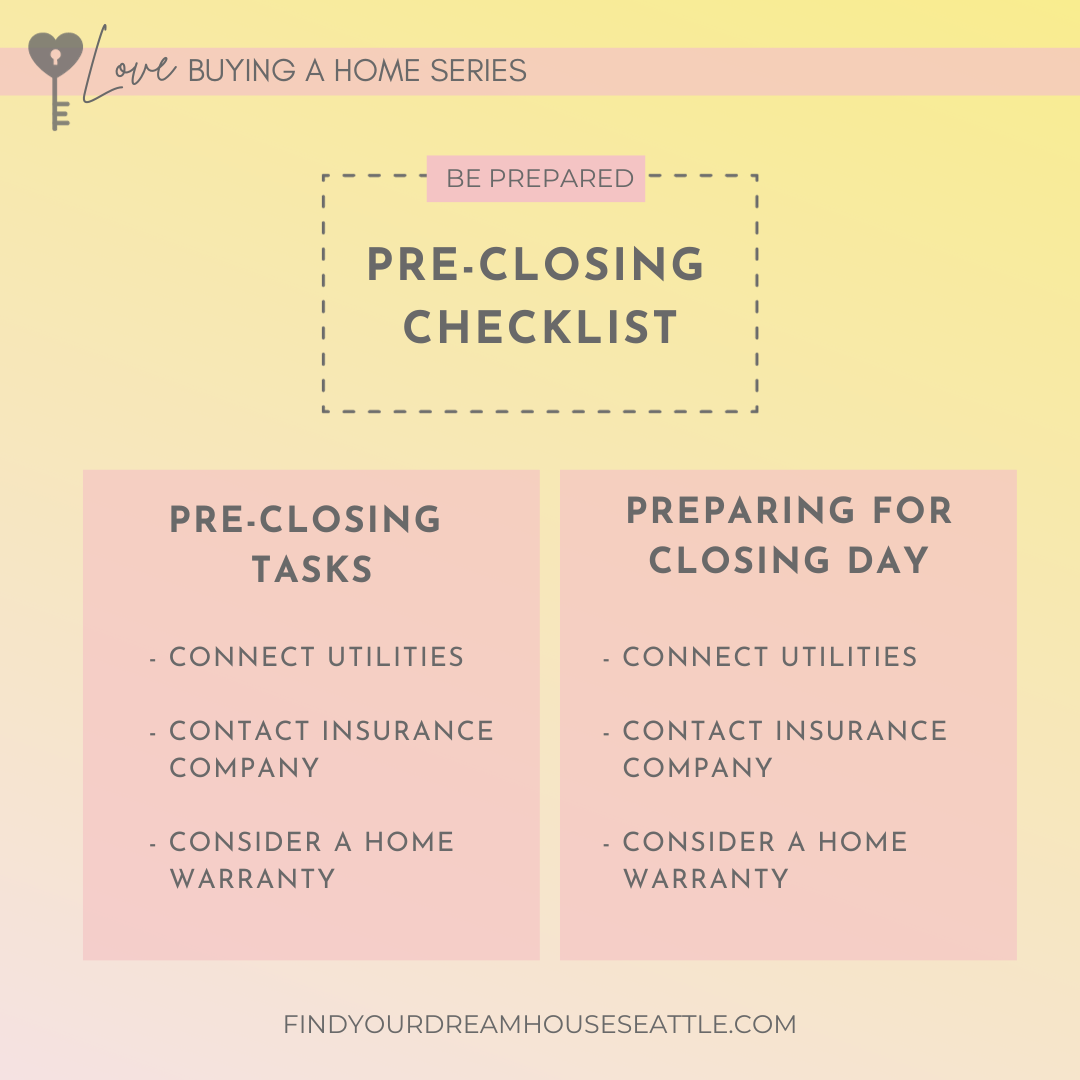

Almost There … Pre-Closing Details for Buyers Love Buying a Home series – Week 12 This step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make […]

continue reading...

Move-Up Strategies to “Buy First Then Sell” How to Move Up to Your Next Home with Ease – Week 5 This 5-part series is a “how-to” guide for moving up to your next home with as little stress as possible. Whether it’s your first time moving up or you’ve done it before, this series is […]

continue reading...

Successful Strategies for You to “Sell First Then Buy” How to Move Up to Your Next Home with Ease – Week 4 This 5-part series is a “how-to” guide for moving up to your next home with as little stress as possible. Whether it’s your first time moving up or you’ve done it before, this […]

continue reading...

How to Buy Your First Home with Zero Downpayment One of the hardest parts of buying a home for the first time is getting a downpayment together. It can feel harder and harder over time, the more we have to pay in rent and other increasing living expenses, the harder it is to save. It […]

continue reading...

Review those Condo Docs! Love Buying a Home – Week 11 This step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure to tune in […]

continue reading...

The Big Move-Up Buyer Question: How Do You Buy and Sell at the Same Time? How to Move Up to Your Next Home with Ease — Week 3 This 5-part series is a “how-to” guide for moving up to your next home with as little stress as possible. Whether it’s your first time moving […]

continue reading...

What Move-Up Buyers Need to Ask Themselves FIRST How to Move Up with Ease Series –Week 2 This 5-part series is a “how-to” guide for moving up to your next home with as little stress as possible. Whether it’s your first time moving up or you’ve done it before, this series is a great […]

continue reading...

Hi, I’m Rose Voorhees and I love helping first time homebuyers in Seattle make buying their first home more affordable. Let me show you how!

Having lived and worked in Seattle for over a decade, I am passionate about making homeownership accessible to the people responsible for this city's valuable culture and community.

For that reason, I work with first time homebuyers to help them build wealth and stability in a city where rent continually prices out the very people who built it.

Contact me today to learn how to achieve your homeownership dreams. Schedule a free consultation now!